Logo (WIPO, 04/03/2018)

Protect this trademark from copycats!

With our trademark monitoring alerts, you are automatically notified by email about copycats and free riders.

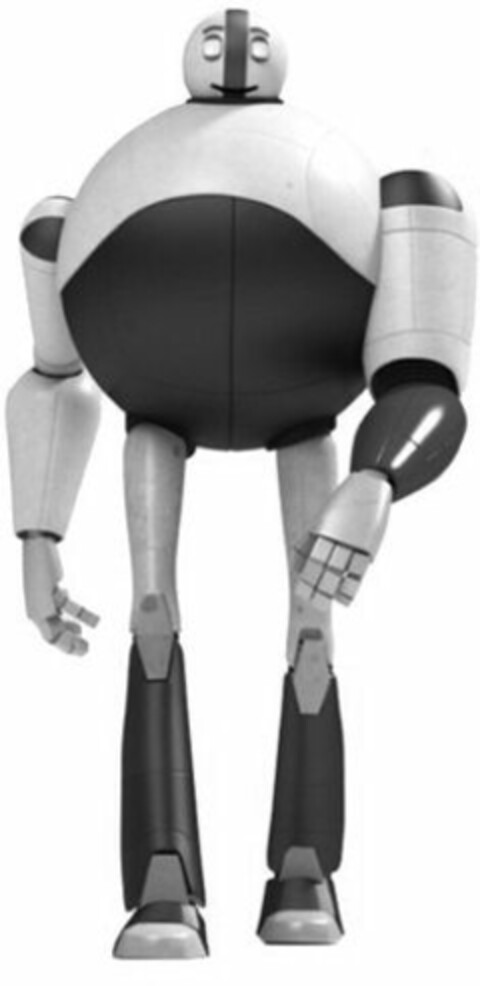

The International trademark was filed as Figurative mark on 04/03/2018 at the World Intellectual Property Organization.

Logodesign (Wiener Klassifikation)

#Plants, objects or geometrical figures representing a personage or an animal; masks or fantastic or unidentifiable heads #Robots of human appearance

| Trademark form | Figurative mark |

| File reference | 1433588 |

| Countries |

|

| Base trademark |

No. 87861389,

April 3, 2018

No. 87861389,

April 3, 2018

|

| Application date | April 3, 2018 |

| Expiration date | February 10, 2020 |

Trademark owner

2535 Garcia Avenue

Mountain View CA 94043

US

Mountain View CA 94043

US

Trademark representatives

801 California Street,

Silicon Valley Center

US

goods and services

35

Consultation, advisory, analysis, and assistance services

with regard to personal and small business accounting and

taxes; consultation and advisory services in the fields of

personal and small business accounting and taxes, including

tax calculation, tax planning, tax return preparation, tax

refund, tax management, preparation of tax forms, and tax

return filing; providing tax and tax preparation management

information and consultation; providing information

concerning personal and small business accounting, taxes,

tax calculation, tax planning, tax return preparation, tax

refunds, tax management, preparation of tax forms, and tax

returns filing; providing tax analysis and calculation in

the nature of personal and small business accounting and

assessment, planning, preparation, and filing services;

providing advice, analysis, news, and opinions to consumers

in the fields of tax return preparation and tax planning;

providing tax calculation, planning, preparation, and filing

services; electronic tax filing services; consultation,

advisory, analysis, and assistance services with regard to

aggregating wage, interest, dividend, and other income and

expense information from a wide variety of sources for tax

related purposes; consultation, advisory, analysis, and

assistance services with regard to organizing, tracking and

reporting tax deductible expenses; loan comparison services,

namely, rate comparison services related to obtaining loan

financing, personal loans, peer-to-peer loans, lending

products that match investors with borrowers, and student

loans; online business management services in the field

business finance; online accounting and bookkeeping

services; providing payroll preparation, payroll tax

assessment, and payroll tax filing services; member benefits

program, namely, customer loyalty services for commercial,

promotional and/or advertising purposes that provides a

variety of amenities to member accounting professionals,

computer consultants, tax professionals, and business

consultants; administration of loyalty programs for member

accountants; membership club services, namely, providing

on-line information to members in the fields of branding,

business development, business marketing, and marketing

advertising; marketing consultation; online marketing and

promotional services; online advertising of the goods and

services of others; providing search engine marketing

information; providing product and computer software

discounts, namely, administration of a program for enabling

participants to receive free product samples and enabling

participants to obtain discounts on products and discounts

on computer software; providing insurance policy comparisons

and referrals to insurance providers; commercial

intermediation services to connect consumers to offers that

provide lower interest rates and fees; commercial

intermediation services to connect consumers to offers for

financial services

36

Consultation, advisory, analysis, and assistance services

with regard to tax payment management; providing analysis

and calculation of tax payments; provision of information

concerning tax payment management; on-line banking services

enabling users to directly deposit tax refunds into accounts

at financial institutions; debit account and refund account

services for the payment and deposit of tax refunds;

transaction processing services for financial institutions

and consumers, namely, processing of debit card transactions

and tax refunds; transaction processing services related to

deposits of tax refunds; online debit, pre-paid,

stored-value and reloadable card balance and account

tracking services accessed via secure internet banking

platforms; providing online financial calculators; providing

financial information relating to medical care subsidies via

a website featuring online links to the websites of others;

financial management services via global computer networks;

online refinancing of educational student debt and other

debt obligations; providing online services to optimize

interest and fees for financial and card accounts; providing

information to consumers in the fields of personal and small

business financial management; providing information to

consumers and small businesses on optimizing interest and

fees for financial and card accounts; financial risk scoring

and modeling services; providing financial history, payment

history, loan and debt burden information to consumers;

financial consulting services, namely, providing consumers

with insights into how they compare against others like them

in the fields of finance, financial investments, financial

valuations, and the financial aspects of retirement;

providing aggregated and anonymized financial data to others

for economic and financial trend analysis; providing

financial data analysis and financial advice; providing

automated recommendations on choosing financial services;

providing information on optimizing interest and minimizing

fees for financial and card based accounts; loan comparison

services, namely, providing information related to obtaining

loan financing, personal loans, peer-to-peer loans, and

student loans; loan comparison services, namely, providing

information on qualifying requirements related to obtaining

loan financing, personal loans, peer-to-peer loans, and

student loans; online banking services; providing mortgage

loans, business loans, automobile loans and personal loans;

issuance of credit cards and prepaid cards; estate planning

services; financial planning services, retirement planning

services; electronic payment processing services; electronic

money transfer services; bill payment services; credit

reporting services, credit monitoring services; credit

scoring services; electronic monitoring of credit card

activity and credit reports; online credit card transaction

processing services; payroll tax debiting services; online

bill payment services

42

Providing temporary use of on-line non-downloadable software

for tax planning, tax calculation, and tax return

preparation and filing; software as a services (SAAS)

services featuring software for tax planning, tax

calculation, and tax return preparation and filing,

processing tax payments, and for organizing, tracking and

reporting tax-deductible expenses; providing temporary use

of online non-downloadable software for processing tax

payments; providing temporary use of online non-downloadable

software for organizing, tracking and reporting tax

deductible expenses; providing temporary use of online,

non-downloadable mobile application software for tax

planning, tax calculation, and tax return preparation and

filing, processing tax payments, and for organizing,

tracking and reporting tax-deductible expenses; providing

temporary use of non-downloadable software for customers to

directly deposit tax refunds into accounts at financial

institutions; providing temporary use of non-downloadable

software to pre-populate tax forms with tax data from online

banking accounts; providing temporary use of online

non-downloadable software for determining eligibility for

healthcare subsidies and for calculating healthcare

subsidies; providing temporary use of on-line

non-downloadable software that enables multiple users to

screen share and communicate for use in providing remote

technical support of software and remote technical support

in the fields of tax return preparation, tax return filing,

personal and small business accounting, financial

management, and generating and submitting applications for

financial services; providing temporary use of online

non-downloadable software that enables multiple users to

screen share and communicate for use in providing assistance

with regard to accounting and taxes; providing temporary use

of on-line non-downloadable software that enables users to

capture, upload, download, store, organize, view, create,

edit, encrypt, send and share receipts, documents,

information, data, images, photographs, and electronic

messages, all in the fields of tax planning, tax return

preparation, tax return filing, personal and small business

accounting, financial management, and generating and

submitting applications for financial services; providing

temporary use of online non-downloadable software for use in

providing assistance with regard to accounting and taxes;

providing temporary use of on-line non-downloadable software

that enables communication between tax professionals and

customers; providing temporary use of on-line

non-downloadable software that enables communication between

technical support representatives and customers; providing

temporary use of on-line non-downloadable software for use

in providing technical support; providing temporary use of

on-line non-downloadable software for use in troubleshooting

problems with tax preparation, computer software and online

services via telephone, online chat, e-mail, video and other

means; providing a website featuring interface system

technology that prompts users with personalized instructions

based on real time analysis of the user's question structure

and semantics (terms considered too vague by the

International Bureau - rule 13 (2) (b) of the Common

Regulations); providing temporary use of non-downloadable

computer software featuring interface system technology that

prompts users with personalized instructions based on real

time analysis of the user's question structure and

semantics; providing a website featuring technology that

advises users on re-phrasing questions using personalized

tips to guide users (terms considered too vague by the

International Bureau - rule 13 (2) (b) of the Common

Regulations); providing a website featuring technology that

enables users to post and respond to questions in the fields

of tax and healthcare subsidies (terms considered too vague

by the International Bureau - rule 13 (2) (b) of the Common

Regulations); providing a website featuring technology that

enables users to contribute and edit digital content in the

field of tax (terms considered too vague by the

International Bureau - rule 13 (2) (b) of the Common

Regulations); providing a website featuring technology that

enables users to determine eligibility for healthcare

subsidies (terms considered too vague by the International

Bureau - rule 13 (2) (b) of the Common Regulations);

providing a website featuring technology that enables users

to calculate healthcare subsidies (terms considered too

vague by the International Bureau - rule 13 (2) (b) of the

Common Regulations); creating and hosting an online

community featuring shared communications in the fields of

tax and healthcare subsidies; technical support services,

namely, troubleshooting problems with computer software and

online services via telephone, e-mail and other means;

providing temporary use of non-downloadable software for use

in connecting consumers with third-party financial services;

providing temporary use of non-downloadable software for use

in providing automated personal and small business financial

management services; providing temporary use of

non-downloadable software for use in asset allocation and

sector analysis; providing temporary use of non-downloadable

software for consumers to create a unified financial profile

for themselves, their businesses and their families;

providing temporary use of non-downloadable software for use

by consumers and small businesses to aggregate, access, view

and manipulate financial records from multiple accounts in a

single location; platform as a service (PAAS) featuring

computer software platforms for use by consumers and small

businesses to aggregate, access, view, manipulate and share

financial records from multiple accounts in a single

location; computer security consultancy in the field of

computer fraud protection services; computer security

consultancy in the field of identity protection and

restoration; providing on-line non-downloadable computer

software for tracking and management of digital currency and

virtual currency; providing on-line non-downloadable

computer software for electronic payments and money

transfers; providing on-line non- downloadable computer

software for investment management and tracking; providing

on-line non-downloadable computer software for bill payment;

providing on-line non-downloadable computer software for

personal and small business financial management; providing

on-line non- downloadable computer software for online

banking, transaction management, financial planning,

financial management, bill tracking and management, expense

tracking and management and accounting; providing on-line

non-downloadable computer software for creating reports and

graphs; providing on-line non-downloadable computer software

for forecasting and analysis of data; providing on-line non-

downloadable computer software for data aggregation;

providing on-line non-downloadable computer software for

providing banking, financial and bill payment alerts;

providing on-line non-downloadable computer software for

providing wireless access to data and databases; providing

on-line non-downloadable computer software for enabling

users to retrieve financial account balances and financial

transaction information using mobile phones, smart phones,

and mobile telecommunication networks; providing temporary

use of online non-downloadable software for accounting,

bookkeeping, online financial and business transaction

processing management, financial and business transaction

management, tax preparation and tax planning, business

process management, and financial planning; providing

temporary use of online non-downloadable software for use in

the field of personal and business finance for accounting,

project costing management and tax management; providing

temporary use of online non-downloadable software for use in

the management of payroll; providing temporary use of online

non-downloadable software for administering employee

payroll; providing temporary use of online non-downloadable

software for use in the management of benefit plans,

insurance plans, retirement plans, unemployment insurance

plans, and pre-paid health care plans; providing temporary

use of online non-downloadable software for creating,

customizing, and managing invoices, recording payments, and

issuing receipts; providing temporary use of online

non-downloadable software for use in organizing, servicing

and tracking sales, collections and receivables data;

providing temporary use of online non-downloadable software

for tracking income, expenses, sales, and profitability by

business location, department, type of business, or other

user set field; providing temporary use of online

non-downloadable software for customer relationship

management; providing temporary use of online

non-downloadable software to calculate and charge sales tax

and to create reports to pay sales tax to appropriate tax

agencies; providing temporary use of online non-downloadable

software for credit card invoicing and credit card payment

processing; providing temporary use of online

non-downloadable software for managing online bank accounts;

providing temporary use of online non-downloadable software

for controlling access to financial information via

electronic permission settings; providing temporary use of

online non-downloadable software to create, customize,

print, export, and e-mail purchase orders; providing

temporary use of online non-downloadable software to track

time worked by employees and subcontractors; providing

temporary use of online non-downloadable software to create

and manage budgets; providing temporary use of online

non-downloadable software to create price quote estimates

and transfer price quote estimates to invoices; providing

temporary use of online non-downloadable software to

automate creation of invoices; providing temporary use of

online non-downloadable software to create, customize,

print, export, and e-mail financial reports, business

reports, balance sheets, profit and loss statements, cash

flow statements, and taxable sales reports; providing

temporary use of online non-downloadable software to create,

print, and track checks and purchase orders; providing

temporary use of online non-downloadable software to track

sales, expenses, and payments; providing temporary use of

online non-downloadable software to analyze the financial

status of businesses and industries; providing temporary use

of online non-downloadable software to manage customer

lists, e-mail and print sales forms, and track running

balances; providing temporary use of online non-downloadable

software for inventory management; providing temporary use

of online non-downloadable software to import contacts and

financial data from other electronic services and software;

providing temporary use of online non-downloadable software

for synchronizing data among computers and mobile devices;

providing temporary use of online non-downloadable software

for database management, data aggregation, data reporting,

and data transmission; providing temporary use of online

non-downloadable software for online backup of electronic

files; providing temporary use of online non-downloadable

software for use in transaction processing, accounting,

receipt printing, customer relationship management,

inventory management and operations management, all in the

field of point of sale transactions and retail management;

technical support services, namely, troubleshooting of

computer software problems, web sites, online services, web

and online application problems, mobile application

problems, and network problems; technical support services,

namely, help desk services; computer services, namely,

synchronizing data among computers and mobile devices;

computer consultation services; data hosting services;

hosting software for use by others for use in managing,

organizing and sharing data on computer server on a global

computer network

Trademark history

| Date | Document number | Area | Entry |

|---|---|---|---|

| September 14, 2020 | 2020/41 Gaz | US | RAW: Total Ceasing Effect |

| May 11, 2020 | 2020/20 Gaz | KR | RAW: Rule 18ter(2)(ii) GP following a provisional refusal |

| February 21, 2020 | 2020/9 Gaz | MX | Rejection |

| February 7, 2020 | 2020/8 Gaz | SG | RAW: Rule 18ter(2)(ii) GP following a provisional refusal |

| January 9, 2020 | 2020/2 Gaz | JP | Rejection |

| September 3, 2019 | 2019/36 Gaz | IL | Rejection |

| September 3, 2019 | 2019/36 Gaz | NZ | RAW: Rule 18ter(2)(i) GP following a provisional refusal |

| August 7, 2019 | 2019/32 Gaz | KR | Rejection |

| July 9, 2019 | 2019/32 Gaz | AU | RAW: Rule 18ter(2)(ii) GP following a provisional refusal |

| June 24, 2019 | 2019/26 Gaz | IN | Rejection |

| April 15, 2019 | 2019/16 Gaz | EM | Rejection |

| April 15, 2019 | 2019/16 Gaz | AU | Rejection |

| March 26, 2019 | 2019/14 Gaz | NZ | Rejection |

| March 22, 2019 | 2019/13 Gaz | CN | Rejection |

| March 1, 2019 | 2019/11 Gaz | PH | Rejection |

| January 14, 2019 | 2019/3 Gaz | SG | Rejection |

| April 3, 2018 | 2018/43 Gaz | US | Registration |

ID: 141433588

WIPO

WIPO